Articles: Latest

- Lens on New India

- The totalitarian project behind the electoral bonds scheme

- Sreedhar Ramamurthi: A geologist who campaigned for Mother Earth

- FPJ Exclusive: Big Players Who Bought Electoral Bonds

- A tell-all exposé on policy battles and power games in India’s economic corridors

- An Amazing ‘Zoo Story’

- Too Little Too Late, Yet Better Late Than Never

- Interim Budget 2024: Confidence Or Bravado?

- BLS International: From Diplomatic Storms in Canada to E-Residency Scams in Estonia

- On polling matters

Featured Book: As Author

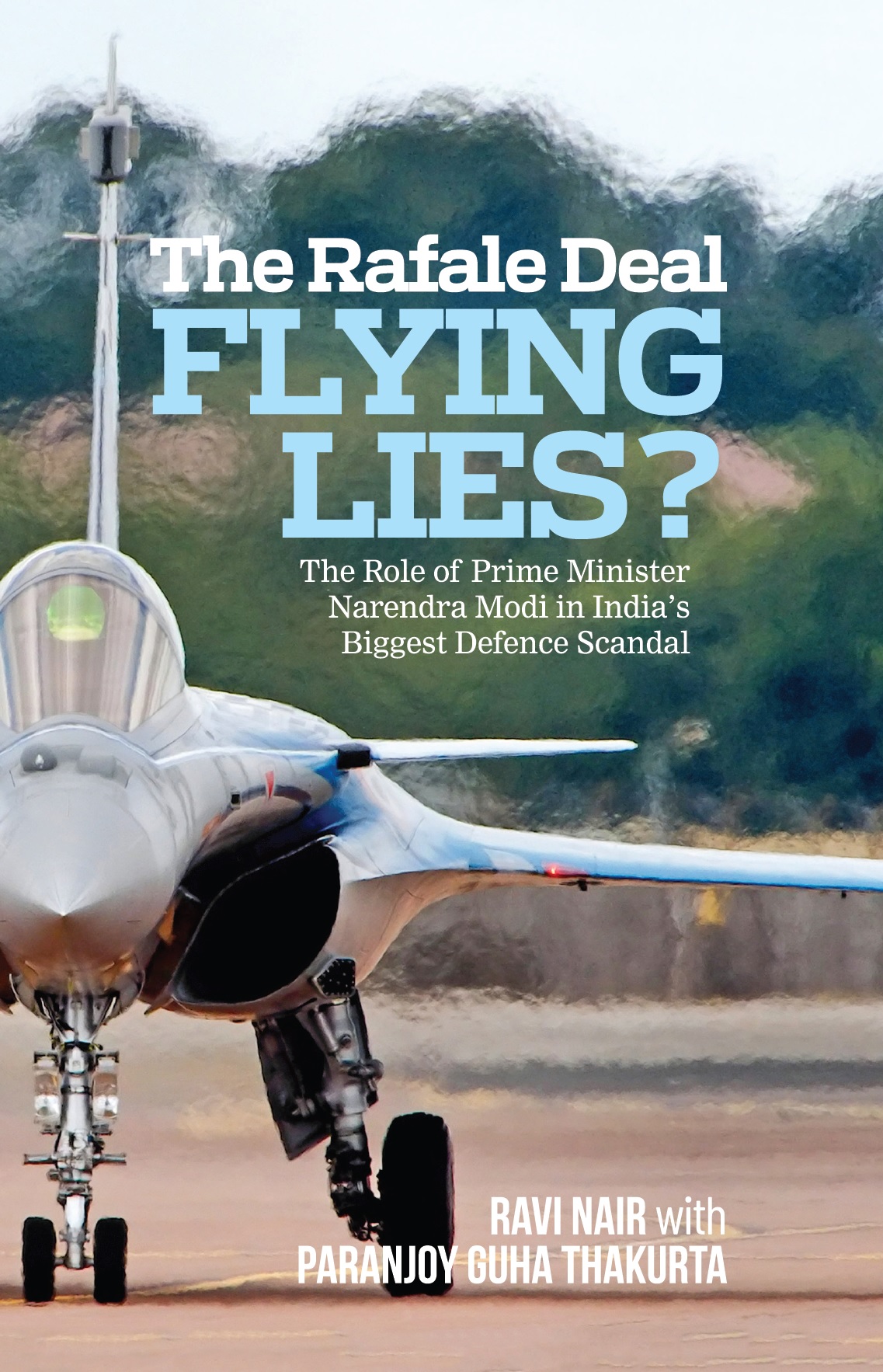

Flying Lies?

The Role of Prime Minister Narendra Modi in India's Biggest Defence Scandal

- Publisher: Paranjoy

- 560 pages

- Published month:

- Buy from Amazon

- Buy from Flipkart

Also available:

Link of the recording of the 70-minute deposition on 14 February 2022 by Paranjoy Guha Thakurta to the Supreme Court-appointed committee headed by Justice (retired) R V Raveendran on allegations of misuse of the Israeli Pegasus spyware on Indian citizens: https://pegasus-india-investigation.in/depositions/paranjoy-guha-thakurta-statement/