A recent column by Bloomberg Opinon’s Andy Mukherjee focussed attention on potential issues of conflict of interest arising out of the position held by Adani Group Chairman Gautam Adani’s daughter-in-law Paridhi Adani in a top Indian law firm that frequently advises companies in the Adani Group. On 2 September, AdaniWatch examined this issue further, detailing 12 cases in which Paridhi’s law firm had advised on major deals between Adani companies and other parties.

In this story, AdaniWatch examines two examples where the appointment of someone to the board of an Adani company has raised eyebrows.

Dinesh Kanabar, the ‘independent’ director

Dinesh Kanabar is the CEO and founder of Dhruva Advisors – a tax and regulatory advisor – who has extensive experience in the Indian corporate world, including a tenure as a member of the board of directors and a key managerial person at the National Stock Exchange (NSE), India’s largest stock exchange.

On 5 January 2021, Kanabar was appointed independent director at Adani Green Energy Limited (‘Adani Green’). Kanabar, an alumnus of two of the ‘Big 4’ consultancies worldwide, Pricewaterhouse Coopers and KPMG, is well-known in the Indian corporate world for his expertise in taxation. He serves on the National Executive Committee of the Federation of Indian Chambers of Commerce and Industry (FICCI), a major apex lobby group for big business. He was a former member of the board of directors and a member of management at the (NSE) National Stock Exchange. Kanabar clearly brings a wealth of experience and knowledge to the table; what raises concerns is the close relationship between Dhruva Advisors and the Adani Group.

As with the story about Paridhi Adani, the critical issue is whether Kanabar and/or his company, Dhruva Advisors, are ‘related parties’ to the various Adani companies discussed below as defined by the Companies Act 2013 (see appendix).

Our argument is that all the companies in the Adani Group are related parties by virtue of their ownership and common directors across their boards. This makes all of those companies ‘related parties’ to Kanabar, by virtue of his own position on the Adani Green board of directors. This means that Kanabar's advisory firm, Dhruva Advisors, is also a related party to all the companies in the Adani Group. In that case, all transactions (such as payments of fees) between Adani companies and Dhruva Advisors should have been disclosed – to the stock markets by the relevant companies in the Adani Group and in their financial statements to the Ministry of Corporate Affairs by the Adani companies and Dhruva Advisors – as ‘related party’ transactions.

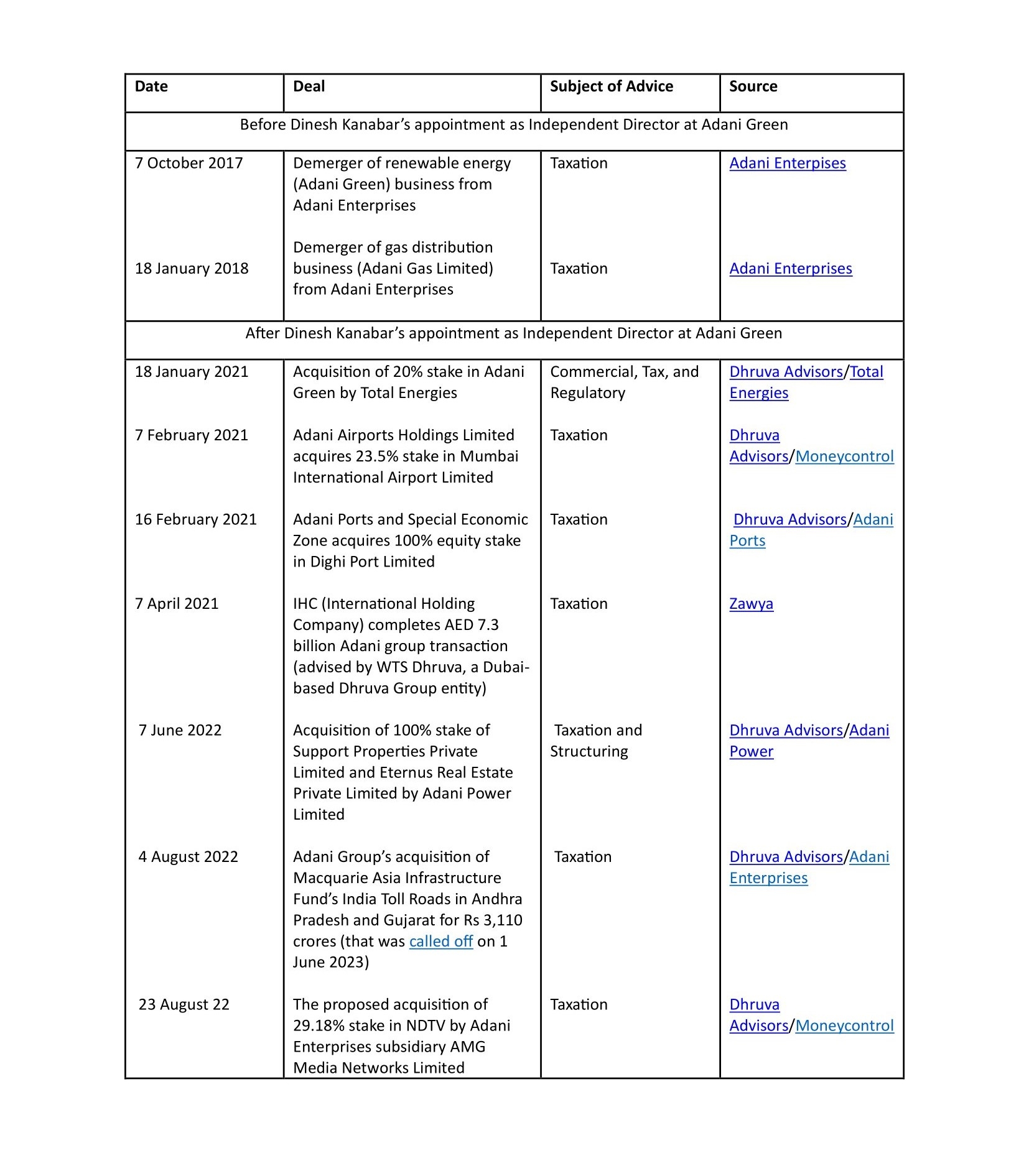

Dhruva Advisors has acted as a tax advisor in several transactions involving mergers, acquisitions, and demergers within the Adani Group. Here is a list of deals where Dhruva Advisors and related entities have advised Adani Group companies, both before and after Kanabar’s appointment to Adani Green’s board:

N.B. In the ‘sources’ column, where the source is attributed as Dhruva Advisors in addition to another source – the secondary source is providing the date of the announcement of the deal, while the Dhruva Advisors website is the primary source stating that it provided advisory services for the deal.

Adani Green appears to have failed to disclose its possible ‘related party’ transactions with Dhruva Advisors, despite the firm providing tax-advisory services to other companies in the Adani Group (that is, related parties to Adani Green) and receiving remuneration for its work.

Dhruva Advisors may come under the ‘professional advice’ caveat of the definition of a related party, when its advice pertains to Adani Green. However, it is important to note that Kanabar’s appointment letter issued by Adani Green dated on 5 January 2021 almost certainly would have obliged him to ‘not involve in a situation in which he/she may have a direct or indirect interest that conflicts, or possibly may conflict, with the interest of the Company’ – see sample appointment letter.

Under the Companies Act of 2013, independent directors are subject to restrictions on pecuniary transactions with the company. The law prohibits independent directors from having a pecuniary relationship, except for remuneration as a director or transactions that do not exceed 10% of their total income or as prescribed by regulations.

In addition, if a person has been an employee, proprietor or partner in a firm of auditors, company secretaries, cost auditors, or a legal or consulting firm that has had transactions with the company, its holding, subsidiary, or associate company amounting to 10% or more of the gross turnover of such a firm in the three financial years preceding their appointment, they would be ineligible to serve as an independent director.

These regulations aim to ensure that independent directors do not have significant financial relationships with the company they are serving. It appears unusual for a firm managed by an independent director of a Group company to have been advising the Group on key deals for an extended period. The lack of transparency regarding the details of fees received by the firm from these transactions adds further complexity to the situation.

Does Kanabar’s position as an independent director of Adani Green while his firm is part of various transactions with other Adani Group companies constitute a conflict of interest? Did he recuse himself from his advisory firm’s work advising Adani Group companies? Does his appointment as an independent director of Adani Green protect the interests of its shareholders, particularly its minority shareholders? Should the relevant Adani Group company and Dhruva Advisors have disclosed the status of Kanabar and/or Dhruva Advisors as a related party in each of the deals described above?

This is what Kanabar stated in his response to a questionnaire we emailed him:

‘You will appreciate that I cannot respond to client-related matters on account of confidentiality reasons. Within that limitation, I respond to your questions as under:

- I have duly intimated Adani Green Energy Limited that I am a Partner in Dhruva Advisors LLP and my appointment as an Independent Director is in conformity with the provisions of the Companies Act.

- ‘The fees received by Dhruva Advisors from Adani Green or, for that matter, from the entire Adani Group is a very insignificant percentage of the fees earned by the firm. The services rendered are in the ordinary course of business.

- ‘The nature of services rendered by Dhruva Advisors does not result in direct or indirect interest that conflicts or may possibly conflict with the interest of the Company.’

The absence of disclosure could impact the interests of minority shareholders in Adani Group companies. Potential conflicts of interest could assume significance because these bear upon the management of large assets in the country, including more than a dozen seaports and airports operated by the group.

Ameet Desai, former CFO turned independent director

Ameet Desai is a former employee of the Adani Group. He has been the Chief Financial Officer (CFO) of Adani Power and Adani Enterprises and holds positions on the boards of various Group companies. Desai was recently appointed as an independent director at Ambuja Cement – a cement manufacturer that the Adani Group acquired in 2022. Ameet Desai was appointed as an independent director at Ambuja Cements on 16 September 2022.

According to the Financial Express, the independent firm Institutional Investor Advisory Services India (IiAS) ‘asked shareholders to vote against the appointment of Ameet Desai… as independent director… as Desai, who had held various positions with Adani Group, did not have a cooling-off period’.

Without using the term explicitly, the Companies Act specifies that a ‘cooling-off period’ of three years must pass between a person’s employment by a company and their appointment by the company or its related parties as an independent director.

Section 149 (6) (c) of the Companies Act specifies that only a person ‘who has or had no pecuniary relationship with the company, its holding, subsidiary or associate company, or their promoters, or directors, during the two immediately preceding financial years or during the current financial year’ can be appointed as an independent director of a company. Based on publicly available data, Desai appears to be in violation of this clause. Desai remains a director of multiple Adani group companies to this day. These include Adani Cements Limited (since 2009), Adani Aerospace and Defence Limited (since 2015), Adani Logistics Limited (since 2005), Adani Naval Defence Systems and Technologies Limited (since 2015), Adani Defence Systems and Technologies Limited (since 2015), among others.

As directors are paid a salary or fee for their services, it can be argued that Desai has been in a pecuniary relationship with the promoters of the Adani Group during the two financial years that immediately preceded his appointment as a director at Ambuja Cements, by the same promoters, following the acquisition of the cement firm by the Adani group.

This was the reason cited by a ‘proxy advisory’ firm for asking shareholders of Ambuja Cements to reject Desai’s appointment as independent director.

Was Desai’s appointment then violating the law? Is his appointment as independent director appropriate for the protection of the interests of Ambuja Cements shareholders, particularly its minority shareholders? At the time of publication, he had not responded to our emailed questionnaire of 1 August 2021 wherein we asked these questions.

The authors are independent journalists.

Appendix

The full definition of ‘related party’ in the Companies Act with the relevant parts (for the purpose of this article) highlighted:

(76) “related party”, with reference to a company, means—

(i) a director or his relative;

(ii) a key managerial personnel or his relative;

(iii) a firm, in which a director, manager or his relative is a partner;

(iv) a private company in which a director or manager 1[or his relative] is a member or director;

(v) a public company in which a director or manager 2[and holds] is a director or holds along with his relatives, more than two per cent. of its paid-up share capital;

(vi) any body corporate whose Board of Directors, managing director or manager is accustomed to act in accordance with the advice, directions or instructions of a director or manager;

(vii) any person on whose advice, directions or instructions a director or manager is accustomed to act:

Provided that nothing in sub-clauses (vi) and (vii) shall apply to the advice, directions or instructions given in a professional capacity;

(viii) any company which is—

(A) a holding, subsidiary or an associate company of such company; or

(B) a subsidiary of a holding company to which it is also a subsidiary;

(C) an investing company or the venturer of the company;";

Explanation — For the purpose of this clause, “the investing company or the venturer of a company” means a body corporate whose investment in the company would result in the company becoming an associate company of the body corporate.]

(ix) such other person as may be prescribed;

(77) “relative’’, with reference to any person, means any one who is related to another, if—

(i) they are members of a Hindu Undivided Family;

(ii) they are husband and wife; or

(iii) one person is related to the other in such manner as may be prescribed;

4 List of Relatives in Terms of Clause (77) of section 2

A person shall be deemed to be the relative of another, if he or she is related to another in the following manner, namely:

(1) Father: Provided that the term “Father” includes step-father.

(2) Mother: Provided that the term “Mother” includes the step-mother.

(3) Son: Provided that the term “Son” includes the step-son.

(4) Son’s wife.

(5) Daughter.

(6) Daughter’s husband.

(7) Brother: Provided that the term “Brother” includes the step-brother;

(8) Sister: Provided that the term “Sister” includes the step-sister.

149 (6) An independent director in relation to a company, means a director other than a managing director or a whole-time director or a nominee director,— …

(c) who has or had no pecuniary relationship with the company, its holding, subsidiary or associate company, or their promoters, or directors, during the two immediately preceding financial years or during the current financial year; …

(e) who, neither himself nor any of his relatives—

(i) holds or has held the position of a key managerial personnel or is or has been employee of the company or its holding, subsidiary or associate company in any of the three financial years immediately preceding the financial year in which he is proposed to be appointed;