Articles: Latest

- Union Budget 2026: FM Nirmala Sitharaman Presents A Lacklustre Budget With No big-bang Announcements

- Why caste census will not annihilate the foundations of inequality

- Institutional Erosion: Mockery of Parliament

- Silence Of The Looms

- Human Rights in New India

- The Oil Triangle: How Putin’s Oil Put Ambani in Trump’s Line of Fire

- Bihar: “Call it a ‘special invasive reconstruction’”

- How India’s Corporate Whistleblowers Face Retaliation & Get No Protection From A Law Govt Keeps Dormant

- Two Books Remind Us of the Importance of June 4, 2024

- DOES MEDIA ADVOCATE PEOPLE’S ISSUES ANYMORE?

Featured Book: As Author

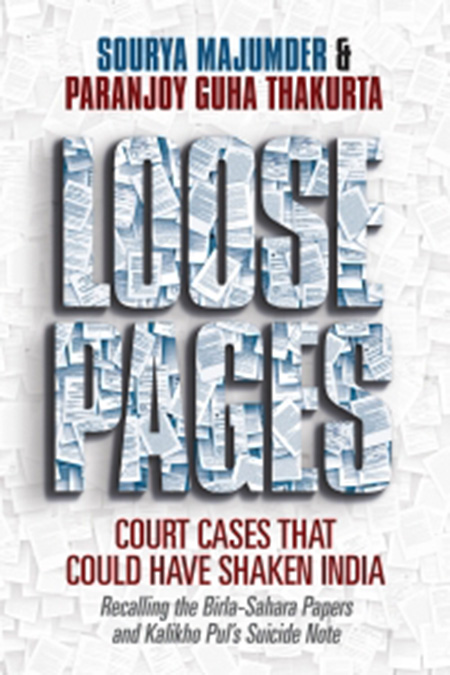

Loose Pages

Court Cases That Could Have Shaken India

- Publisher: Paranjoy

- 376 pages

- Published month:

- Buy from Amazon

Link of the recording of the 70-minute deposition on 14 February 2022 by Paranjoy Guha Thakurta to the Supreme Court-appointed committee headed by Justice (retired) R V Raveendran on allegations of misuse of the Israeli Pegasus spyware on Indian citizens: https://pegasus-india-investigation.in/depositions/paranjoy-guha-thakurta-statement/